In today’s fast-paced world, banking has transcended traditional brick-and-mortar establishments and seamlessly integrated into our digital lives. As a seasoned banking enthusiast who has explored the vast landscape of financial institutions, I can confidently say that Capital One is a name that stands out.

This blog isn’t just a narrative; it’s an experiential journey through the financial realm with Capital One, where I’ll share my encounters, insights, and the fascinating features that make this bank a unique player in the industry.

Table of Contents

A Brief History of Capital One

Before diving into the present-day Capital One experience, it’s essential to appreciate this institution’s journey. Capitol One had modest beginnings as a startup in 1988. Over the years, it became one of the largest and most influential banks in the United States.

Significant milestones, such as acquisitions of other banks, diversification of services, and innovative financial products, marked the journey. These developments laid the foundation for the modern Capital One, which offers millions of customers a wide range of banking products and services.

| Aspect | Details |

| Bank’s History | Founded in 1988, transformed into one of the largest banks in the U.S. |

| Credit Card Options | Diverse credit card lineup, including cashback, travel rewards, and more. |

| Savings Accounts | Competitive interest rates, easy online access, and flexible management. |

| Checking Accounts | A variety of account options are user-friendly online and mobile banking. |

| Loans and Mortgages | Personal, auto, and home loans with competitive rates and convenient online tools. |

| Online and Mobile Banking | Convenient account access, user-friendly interface, and mobile app for on-the-go banking. |

| Digital Wallet and Contactless Payments | Integration with popular digital wallets for secure, contactless transactions. |

| Customer Service Chatbots | 24/7 digital assistants for inquiries and support. |

| Security Measures | Multifactor authentication, rapid response to incidents, customer security education. |

| Capital One Cafes | Unique bank branches offer a relaxed atmosphere and community engagement. |

| Community Engagement | Philanthropy, financial literacy support, and corporate social responsibility initiatives. |

| Case Studies | Real customer experiences that illustrate the positive impact of Capital One’s services. |

Capital One’s Banking Products

Credit Cards: Where it All Began

Capital One’s journey in the financial industry began with a primary focus on credit cards. The company has always been a pioneer in the world of credit, offering innovative and diverse credit card products that have set it apart. These credit cards have been instrumental in shaping Capital One’s identity as a customer-centric bank.

One of the keystones of Capital One’s success is its credit card offerings. The diversity in their credit card products ensures a card for everyone, from cashback enthusiasts to travel lovers. Whether you’re a frequent traveler looking for a card with no foreign transaction fees or someone who prefers straightforward cashback rewards, Capital One has you covered.

Over the years, the Capital One credit card lineup has expanded to cater to various needs and preferences. They’ve introduced co-branded cards in partnership with popular brands and businesses, enabling cardholders to enjoy exclusive benefits and rewards.

Whether you’re looking for rewards in dining, entertainment, retail, or travel, these partnerships have enriched the credit card experience. Accessing features like Sears credit card login has become more convenient with these expanded offerings.

Savings Accounts: Secure Your Financial Future

In modern banking, savings accounts are pivotal in securing your financial future. Capital One is aware of this and provides a range of savings account choices to facilitate the effective growth of your money.

Capital One’s savings accounts provide competitive interest rates that allow your money to work for you. Whether saving for a specific goal, building an emergency fund, or setting aside funds for the future, the bank’s savings accounts make it easier with attractive interest rates.

But what truly sets Capital One apart is the flexibility to manage your savings, including seamless Suddenlink login. Easy online access allows you to monitor your account, make deposits, and access your funds whenever needed. The online platform is designed to offer convenience and control, allowing you to stay connected with your finances in a fast-paced world.

Checking Accounts: Where Convenience Meets Control

Capital One has designed its offerings regarding checking accounts with customers’ needs in mind. They understand that banking should be convenient and easily fit into your daily life. Capital One’s range of checking accounts provides various forms to meet different preferences and requirements.

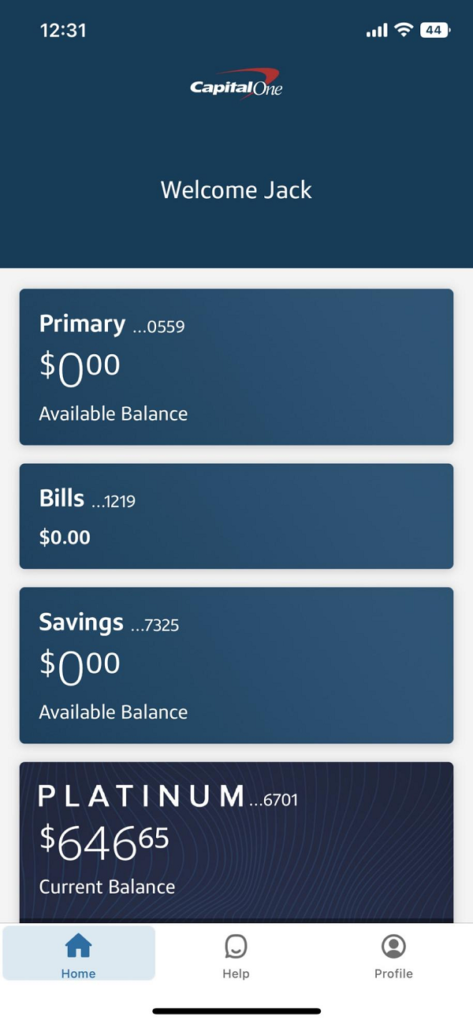

From simple and fee-free checking accounts to those offering interest and premium services, there’s an option for everyone. Capital One’s checking accounts are tailored to make banking straightforward. The user-friendly Capital One app ensures that you can track your transactions, set up direct deposits, and manage your account while on the go, offering a seamless experience similar to the convenience of Amex login. It’s the convergence of convenience and control, providing the best of both worlds.

Loans and Mortgages: Unlocking Financial Opportunities

Capital One is not just about safeguarding your savings or providing credit cards; it’s also about unlocking financial opportunities. Whether you’re looking to consolidate your debt, purchase your dream car, or secure your new home, Capital One’s loans and mortgages are designed to provide the financial solutions you need.

The competitive rates offered by Capital One make borrowing money affordable. These rates help you achieve your financial goals while managing the overall cost. Capital One’s online tools also streamline the application process, ensuring you can easily apply for loans and mortgages.

Their commitment to providing financial opportunities extends beyond traditional lending. Capital One has introduced innovative solutions that simplify the lending experience. From pre-qualification checks that don’t affect your credit score to educational resources that help you make informed financial decisions, they’re dedicated to empowering their customers, even if you’re using a Chase Visa card.

Capital One’s Technological Innovations

Online and Mobile Banking: Your Accounts at Your Fingertips

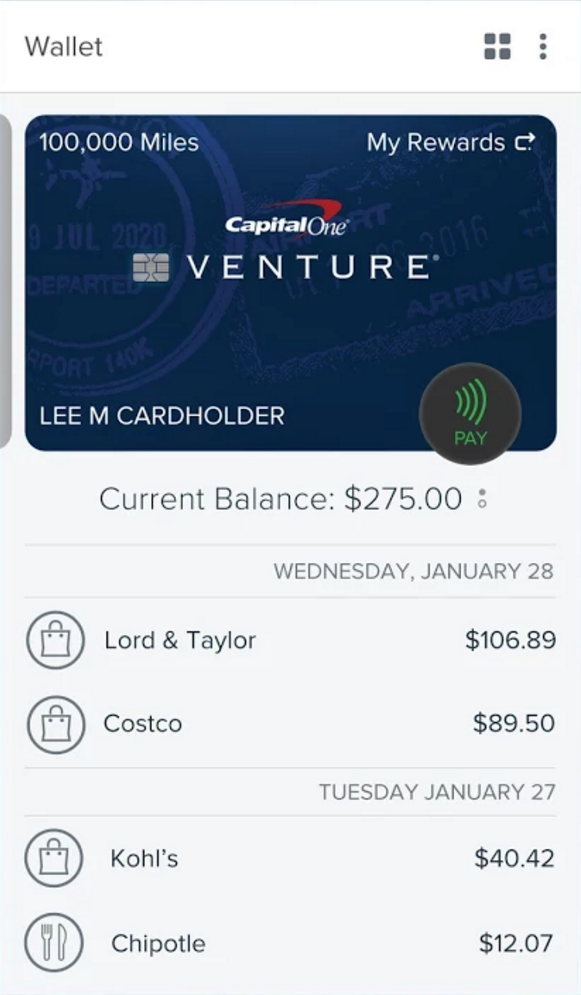

At the heart of the Capital One experience is a strong emphasis on technology, particularly in online and mobile banking. Capital One’s online banking platform is a defining feature that gives customers easy and convenient access to all their accounts. The intuitive and user-friendly interface ensures a seamless experience, whether checking your account balance, transferring funds, or paying bills.

The mobile app offered by Capital One takes this experience a step further. It’s like carrying a virtual branch of the bank in your pocket. With the mobile app, your accounts are always at your fingertips, making banking on the go a reality. You can securely and quickly manage your finances from your mobile device, enhancing control and convenience.

Capital One’s commitment to online and mobile banking doesn’t stop at providing access. They know how crucial security and safety are in the modern digital environment. You may feel secure knowing your financial information is safeguarded thanks to strong security measures and encryption protocols. This combination of accessibility and security ensures that managing your accounts is as stress-free as efficient.

Digital Wallet and Contactless Payments: The Future of Transactions

In an ever-evolving world, Capital One has embraced the future of payments by integrating with popular digital wallets. Digital wallets are transforming how transactions occur, and Capital One’s compatibility with them is a testament to their commitment to providing innovative and secure banking solutions.

By connecting your Capital One credit and debit cards to your chosen digital wallet, you may take advantage of the advantages of safe and practical contactless payments. Whether shopping in-store or online, making payments has never been easier. You can complete transactions swiftly and securely with a simple tap or click. This saves time and offers an added layer of safety by reducing physical contact with payment terminals.

Customer Service Chatbots: Assistance at Any Hour

In a fast-paced world where traditional banking hours may not align with your schedule, Capital One has introduced customer service chatbots to bridge the gap. These digital assistants are available 24/7, ensuring that assistance is just a message away, no matter the time or day.

Capital One’s customer service chatbots are designed to handle various inquiries. They can provide information about your account, assist with balance inquiries, explain specific transactions, and even help with basic troubleshooting. It’s like having a personal banker on call whenever you need them, offering the convenience of around-the-clock support.

These chatbots not only enhance accessibility but also complement the existing customer service infrastructure. They serve as a valuable resource for quick and straightforward queries, freeing up human representatives to focus on more complex customer needs. Whether you’re an early riser or a night owl, you can rest assured that assistance is always within reach.

Capital One’s Commitment to Security

Guardians of Your Finances

Security is a paramount concern for Capital One, and they are committed to safeguarding your financial well-being. The bank places significant emphasis on safeguarding your personal and financial information and implementing robust security measures to protect your assets and data.

One of the notable security features that Capital One offers is multifactor authentication. This adds a layer of security to your online and mobile banking experiences. You can’t access your account without presenting many identity pieces if you use multifactor authentication. This extra step helps ensure that even if your login information is compromised, unauthorized access is still thwarted. It’s an essential component of Capital One’s commitment to providing customers peace of mind in an increasingly digital world.

Rapid Response to Security Incidents

Capital One recognizes that unforeseen security incidents can occur despite their stringent security measures. In such cases, the bank demonstrates its commitment to customer safety by acting swiftly and effectively. They follow industry best practices to address security incidents, focusing on resolving the issue, protecting affected customers, and implementing measures to prevent future occurrences.

The bank’s rapid response strategy ensures that customers can trust their vigilance. Whether it’s addressing a potential data breach or any other security incident, Capital One is well-prepared to take the necessary steps to safeguard your financial interests.

Empowering Customers with Security Education

Capital One goes beyond just implementing technical security measures; they invest in customer education. They understand that an informed customer is the best defense against potential threats. To that end, the bank provides a wealth of resources and information to help customers understand how to protect themselves while engaging in online banking.

Capital One’s commitment to customer education includes guidance on various security aspects. This ranges from recognizing and avoiding phishing attempts to setting up account alerts that notify you of suspicious activities. By educating its customers, Capital One empowers them to make informed and safe banking decisions, further enhancing its reputation as a trustworthy financial institution.

The Capital One Cafe Experience

A Unique Approach to Banking

What sets Capital One apart from other banks is its innovative and customer-centric approach to banking. A notable example of this approach is the introduction of Capital One Cafes. These physical locations go beyond the traditional concept of bank branches, offering customers a welcoming and engaging space.

Capital One Cafes are designed to make the banking experience more relaxed and enjoyable. These spaces are not your typical bank branches but are inviting environments where customers can conduct banking transactions, enjoy a cup of coffee, connect to free Wi-Fi and participate in financial workshops. It’s an innovative and novel approach that redefines the idea of a bank branch.

Building Connections in the Cafes

Capital One Cafes are not just about providing banking services; they are about creating a sense of community. These cafes host a variety of events and workshops covering topics such as budgeting, credit management, and financial planning. The goal is to break down the traditional barriers between banks and their customers.

Capital One aims to make banking more integral to people’s lives by offering these resources and events. It’s about fostering connections and ensuring that customers feel welcome when they visit a cafe and feel supported financially. The cafes become a hub where individuals can manage their financial matters, grow their knowledge, and be part of a larger community that values financial well-being.

Capital One’s Community Engagement

Corporate Social Responsibility

As part of its corporate social responsibility, Capital One goes beyond just banking. The bank is involved in programs focusing on sustainability, diversity and inclusion, and responsible banking practices. They’ve committed to being a force for good and a catalyst for change.

Investing in Local Communities

Capital One’s commitment to its communities extends beyond banking services. The bank actively invests in and supports local communities through philanthropic efforts and various community-based initiatives. Their dedication to making a positive impact is evident in several ways.

Supporting Local Non-Profits

One of the ways Capital One gives back to local communities is by providing financial support to non-profit organizations. These organizations often play a vital role in addressing community needs, and Capital One’s contributions enable them to continue their important work. Whether it’s supporting organizations that focus on education, healthcare, social services, or other community-driven initiatives, Capital One is dedicated to making a difference at the local level.

Promoting Financial Literacy

Financial literacy is a vital ability that enables people to make wise financial decisions. Capital One recognizes the importance of financial education and actively promotes financial literacy programs within their communities. The bank helps individuals build the knowledge and skills to manage their finances effectively by providing resources, educational materials, and workshops.

Contributing to Causes That Matter

Capital One is committed to contributing to causes that matter most to their communities. Whether supporting environmental conservation, healthcare initiatives, or social justice causes, the bank takes a proactive approach to philanthropy. They give to initiatives that tackle the most urgent issues facing the communities where they do business.

Corporate Social Responsibility

Beyond traditional banking practices, Capital One strongly emphasizes corporate social responsibility. The bank understands that being a responsible corporate citizen involves a broader commitment to societal well-being.

Sustainability Initiatives

Capital One is dedicated to sustainability and environmental responsibility. The bank participates in initiatives to reduce its environmental footprint, conserve resources, and promote sustainability practices. Capital One demonstrates its commitment to a greener future by adopting eco-friendly policies and sustainable business practices.

Diversity and Inclusion

Capital One recognizes the value of diversity and inclusion and actively promotes these principles within the organization. They strive to create an inclusive, diverse workplace, fostering creativity, innovation, and collaboration. By valuing diversity, Capital One is working to build a corporate culture that respects and celebrates individual differences.

Responsible Banking Practices

In addition to providing excellent banking services, Capital One adheres to responsible banking practices. This includes fair lending, ethical financial services, and transparent customer interactions. Capital One’s commitment to responsible banking ensures that customers are treated with integrity and honesty, further enhancing their trust in the bank.

A Force for Good and Catalyst for Change

Capital One’s involvement in local communities and its commitment to corporate social responsibility go beyond traditional banking. The bank actively invests in local non-profits, promotes financial literacy, and contributes to important causes.

Capital One also focuses on sustainability, diversity, and inclusion while adhering to responsible banking practices. Their approach is not only about being a responsible bank but also about being a force for good and a catalyst for positive change in the communities they serve.

Case Studies: Real Customer Experiences

Empowering Customers, One Story at a Time

While understanding the various facets of Capital One’s banking services is essential, the true essence of the Capital One experience shines through the stories of real customers. Let’s take a moment to delve into the experiences of individuals who Capital One’s services have positively impacted. These stories provide a personal perspective on how Capital One has changed real people’s lives.

Case Study 1: Transforming Financial Futures

Meet Sarah, a young professional navigating the complex world of personal finance. Like many individuals, Sarah had dreams and aspirations but wasn’t quite sure how to manage her finances effectively. That’s when she decided to open a Capital One savings account. The process was straightforward, thanks to the user-friendly online platform. With the account in place, Sarah began her journey toward financial stability.

Capital One’s savings account offered Sarah a competitive interest rate, which allowed her savings to grow over time. The convenience of online access meant she could easily check her balance, set up automatic transfers, and monitor her progress. She appreciated the accessibility of the Capital One mobile app, which allowed her to manage her account while on the go.

As Sarah continued to save, she explored the valuable financial resources provided by Capital One. The bank’s commitment to promoting financial literacy offered her guidance on budgeting, setting financial goals, and understanding the importance of building an emergency fund. With Capital One’s support, Sarah saved for her short-term goals and learned to invest wisely for her long-term future.

Case Study 2: A Banking Partner for All Stages of Life

Now, let’s meet Mike and Lisa, a couple at different stages of their financial journey. Mike was a seasoned professional focusing on retirement planning, while Lisa was a recent college graduate starting her career. They both found that Capital One offered solutions tailored to their unique needs.

Mike explored Capital One’s investment options with an eye on his retirement. The bank’s range of investment products allowed him to diversify his portfolio and align his investments with his retirement goals. The user-friendly investment platform made it easy for him to track his investments and stay informed about market trends.

On the other hand, Lisa was looking for a convenient and flexible checking account to manage her everyday finances. Capital One’s range of checking accounts offered her choices aligned with her financial goals. She appreciated the seamless experience of the Capital One app, which allowed her to deposit checks, pay bills, and monitor spending.

Both Mike and Lisa valued the exceptional customer service provided by Capital One. Whether Mike needed guidance on adjusting his investment strategy or Lisa had questions about her account, Capital One’s customer support assisted them. The 24/7 availability of customer service chatbots meant they could get quick answers to their inquiries, no matter the time of day.

Case Study 3: Supporting Dreams and Aspirations

Finally, let’s hear from Alex, an entrepreneur with big dreams. Alex envisioned starting a small business but needed financial support to realize that dream. Capital One’s commitment to offering tailored solutions came to the rescue.

Alex explored the various lending options provided by Capital One, including small business loans. The bank’s competitive rates and straightforward application process allowed Alex to secure the funds needed to launch his business. With Capital One’s support, he took the first step in pursuing his entrepreneurial dream.

In addition to financial assistance, Capital One offered valuable insights and resources for small business owners. Alex took advantage of the financial management tools and educational materials provided by the bank. He better understood budgeting, cash flow management, and strategic financial planning.

The Capital One Cafe in Alex’s community became his go-to place for business meetings and networking. The cafe’s welcoming environment and financial workshops provided him with a space to connect with other entrepreneurs and gain valuable knowledge about running a successful business.

These real-life case studies showcase how Capital One empowers customers at various stages of their financial journeys. From young professionals saving for their future to couples planning their retirement and aspiring entrepreneurs looking for financial support, Capital One offers services tailored to individual needs. The common thread in these stories is the positive impact Capital One has on the financial well-being of its customers, making their dreams and aspirations achievable.

Conclusion

The Capital One experience is more than just banking; it reflects how banking is evolving to meet the dynamic needs of customers. From innovative technological solutions to community engagement and a strong commitment to security, Capital One redefines what it means to be a bank in the modern era.

My journey with Capital One has been one of continuous discovery, and I encourage you to embark on your own to experience the future of banking today. Capital One is not just a bank; it’s a partner in your financial journey, redefining how we bank.